HLB Rebounds After CRL, Eyes FDA Decision by July[K-Bio Pulse]

by나은경 기자

2025.03.26 09:49:56

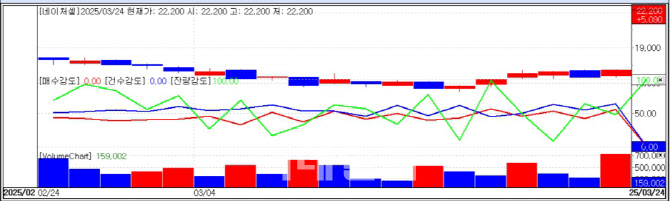

[NA Eun-kyung, Edaily Reporter] On March 24, HLB Group stood out among Korea’s listed pharmaceutical, biotech and healthcare firms. Just three days after announcing it had received a complete response letter(CRL) from the U.S. Food and Drug Administration(FDA) on March 21, more than half of its listed affiliates surged by double digits, staging a notable recovery.

In contrast, Coreline Soft saw a steep drop after disclosing a KRW 31.1 billion rights offering via a late-night filing on March 21.

Shares of HLB-related companies rose across the board after the group announced plans to resubmit a new drug application(NDA) for its liver cancer combination therapy ― ‘Rivoceranib’ plus ‘Camrelizumab’ ― following a second CRL from the FDA.

The rebound came just one trading day after many HLB stocks plunged to daily lower limits. HLB itself ranked 12th in trading volume among all KOSDAQ-listed firms that day.

Among the 11 HLB-affiliated firms listed in Korea, six posted gains exceeding 10%, while the remaining five also closed higher. HLB Pharma, which had fallen to its daily limit on March 21, jumped 24.26% on March 24 ― the biggest gain in the group.

An HLB official said the stock rebound was likely driven by the company’s prompt response to the CRL and its announcement of plans to reapply for NDA in May. The company also emphasized that U.S.-China tensions were unrelated to the FDA’s review of the rivoceranib-camrelizumab combo.

In a press meeting and blog post, HLB stated that it plans to resubmit the NDA within a month of confirming the CRL’s reason ― potentially by May ― and anticipates a response from the FDA by July. Addressing concerns about geopolitical risks, the company added that “in the past two to three years, FDA approvals have been granted for China-developed drugs manufactured in China, suggesting no impact from U.S.-China tensions.”

However, the timeline assumes the application will be reviewed as a Class 1 resubmission. If classified as Class 2, which requires additional site inspections, the review period could extend up to six months. Last year, HLB expected Class 1 review but was ultimately assigned Class 2, warranting cautious investor interpretation.

Coreline Soft, a medical AI company, closed at KRW 2,260 on March 24, down 26.8% from the previous session. The sharp decline followed its March 21 announcement of a KRW 31.1 billion rights offering aimed at securing operational funding through Q4 2027.

Unlike third-party allocations that involve strategic investors with one-year lock-up periods, rights offerings directed at existing shareholders are often perceived as negative due to earnings dilution and increased share supply.

Coreline Soft said the capital raise would support global expansion efforts, especially its subsidiaries in Atlanta and Frankfurt. The company also plans to improve investor communication through a dedicated task force and upcoming IR sessions.

“We’re building a dedicated communications team to respond quickly to investor inquiries and ensure transparency,” a company spokesperson said. “Investor relations with major institutions are also planned, with details to be announced soon.”

Nature Cell was the only biopharma stock to hit its daily upper limit, jumping 29.75% in the main session after initially spiking during pre-market trading. The rally followed news released on March 21 that its stem cell therapy candidate, ‘JointStem’, had received Breakthrough Therapy Designation(BTD) from the FDA.

|

BTD, introduced in 2012, is granted to drug candidates showing substantial improvement over existing therapies during early clinical trials. It enables expedited development and review, increasing the likelihood of approval and shortening timelines.

JointStem, currently in Phase 2b/3a trials under clinical trial approval from both Korea’s MFDS and the FDA, is an autologous adipose-derived stem cell therapy for degenerative osteoarthritis. The company claims it can regenerate cartilage and improve joint function for at least three years through localized knee injections.

However, while BTD boosts visibility, it does not guarantee regulatory approval. According to Pink Sheet, a Pharma Intelligence, only 200 out of 399 BTD-designated drugs had received final FDA approval as of March 2021 ― a success rate of about 50%.