|

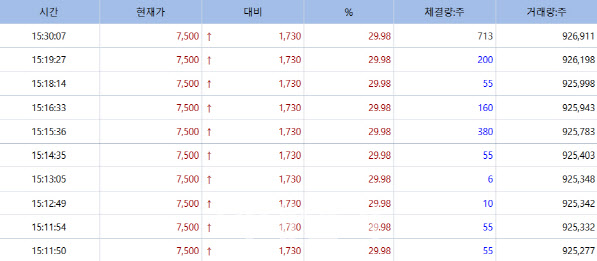

BlueMtech jumped 29.98% to close at 7,500 won, buoyed by explosive growth in sales of Wegovy, Novo Nordisk‘s obesity drug. According to MP DOCTOR (formerly MarketPoint), BlueMtech reported 60 billion won ($44 million) in Wegovy distribution revenue in April, a sixfold increase from the previous month.

BlueMtech operates Bluepharm Korea, an e-commerce platform for pharmaceuticals that distributes Wegovy in South Korea. The company cited enhanced services like same-day delivery in Seoul and membership benefits as drivers behind the revenue surge. The average purchase price also tripled, suggesting a sharp influx of high-volume buyers.

Within just 45 days of launching, more than 28,000 Wegovy prescriptions have been administered in the country. “We’re committed to maintaining a stable supply and enhancing our logistics services, especially ahead of expected summer demand,” said CEO Kim Hyun-soo.

In addition to the Wegovy boom, BlueMtech is betting on its flu vaccine distribution business and expanded cold-chain logistics capabilities. The company acquired a 30.9% stake in Gonggam Plus last year, securing over 100 refrigerated trucks and completing a new temperature-controlled warehouse in July 2023. It also signed a co-promotion deal with Sanofi Korea in August to distribute two flu vaccine products.

HASS Rallies on Elderly Care Policy Momentum

Shares of HASS, a dental prosthetic materials company, surged 16.98% to 10,060 won. The rally came after opposition Democratic Party presidential candidate Lee Jae-myung unveiled a set of senior welfare policies on Parents’ Day, including lowering the age for dental implant health insurance coverage and increasing the number of implants covered per patient.

|

Unlike conventional implant makers, HASS is South Korea’s only manufacturer of lithium disilicate, a high-strength glass-ceramic used in dental restorations. The company holds the No. 3 global market share in this niche segment. Lithium disilicate offers strength and translucency similar to natural teeth, making it ideal for crowns, veneers, and other restorations. Only a few companies worldwide have successfully commercialized this advanced material.

BioSolution Slumps Despite Clinical Win

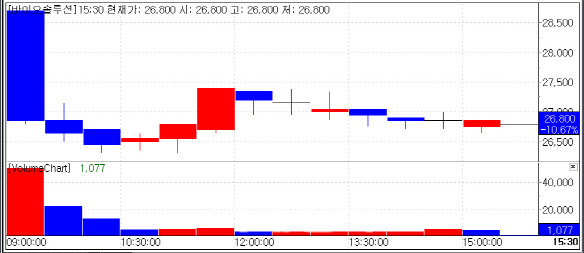

In contrast, BioSolution dropped 10.67% to close at 26,800 won, retreating after a 11.32% gain the previous day. The company had announced promising results from its U.S. Phase 2 trial for CartiLife, a next-generation autologous chondrocyte implantation (ACI) therapy for knee osteoarthritis.

|

The trial, approved by the U.S. FDA in November 2019, enrolled 20 patients across five U.S. sites and completed dosing in January 2024.

Despite the clinical success, investor profit-taking appears to have weighed on the stock. “There are no operational concerns,” a BioSolution spokesperson said. “Given the well-flagged trial timeline, it seems some investors moved to lock in gains.”

The company said it plans to pursue multiple regulatory pathways for early commercialization of CartiLife in the U.S.

![금융당국, 빗썸 ‘유령 코인' 사실상 방치…“감독·제도 공백”[only 이데일리]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021202223t.jpg)

![“실종된 송혜희 좀 찾아주세요!”…25년 동안 딸 그리워한 아빠 [그해 오늘]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021300001t.jpg)