BL Pharmtech appeared to benefit from a PharmEdaily pay to read article reporting that the company is in discussions on a potential license out of its molecular glue technology with companies boasting market capitalizations in the trillions of won.

AbClon’s shares were buoyed by the full conversion of all convertible preferred shares into common stock effectively removing overhang concerns related to potential selling pressure.

Hyundai Bioscience extended its rally for a second consecutive session after deciding to file an application with the U.S. Food and Drug Administration (FDA) for a Phase 2 basket clinical trial targeting respiratory viral diseases.

|

BL Pharmtech in Talks to License Out Molecular Glue Platform Technology

On the day according to KG Zeroin’s MP Doctor (formerly MarketPoint), shares of BL Pharmtech surged 29.86% from the previous session to close at 635 won. A PharmEdaily pay to read article titled “‘Simultaneous talks with companies worth 6, 11 and 26 trillion won in market cap’… BIEL Pharmtech eyes trillion won big deals with molecular glue” reported that the company is holding discussions on a potential license out of its molecular glue platform technology with firms boasting market capitalizations in the multi-trillion won range.

BL Pharmtech’s subsidiary BL Melanithis is developing targeted protein degradation (TPD) based anticancer therapies using molecular glue technology. The company’s drug candidates target alternative lengthening of telomeres (ALT) cancers which account for roughly 10% of all cancers as well as lymphomas that have developed resistance to existing treatments.

Molecular glues induce the forced binding of cancer-related target proteins to E3 ubiquitin ligases, leading to their complete degradation via the proteasome. Compared with conventional kinase inhibitors, molecular glues are considered less prone to the development of drug resistance.

In November last year, BL Melanithis’ molecular glue program was named a final winner of the “2025 Golden Ticket” program hosted by multinational pharmaceutical company Amgen. More than 40 companies participated in the program.

Only two companies were selected as winners PorteRay, which discovers drugs using artificial intelligence (AI)-based analysis and BL Melanithis. Among drug developers, BL Melanithis was the sole awardee. BIEL Pharmtech holds a 34.91% stake in BL Melanithis.

As a result of the award BL Melanithis will receive support including mentoring from Amgen’s global R&D experts residency at the Amgen Golden Ticket Center within the Health Industry Innovation Startup Center and global consulting services covering areas such as clinical trial design.

Korea is reported to be the fifth country worldwide to introduce the Amgen Golden Ticket program following the United States, Canada, Singapore and France.

According to global market research firm Grand View Research the molecular glue based anticancer drug market is expected to grow at a compound annual growth rate of 20.8%, from $540 million in 2024 to $1.69 billion by 2030.

A BL Melanithis official said “We have maintained a policy of strict confidentiality around our technology but following the Amgen award we plan to actively pursue joint R&D and technology collaboration discussions with global big pharma companies.”

adding “We will also expand investor relations (IR) activities targeting interested domestic and overseas investors.”

|

AbClon Eliminates Overhang Concerns After Completing Conversion of Convertible Preferred Shares

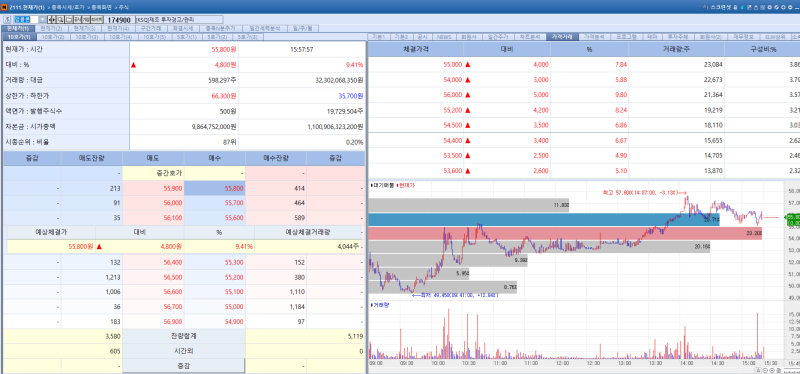

Shares of antibody drug developer AbClon rose 9.41% from the previous session to close at 55,800 won on the day, buoyed by the removal of overhang concerns.

The company said it has completed requests to convert all outstanding convertible preferred shares (CPS) into common stock with the bulk of the shares 617,163 shares listed on the day and the remaining balance scheduled to be listed next week fully eliminating uncertainty related to potential selling pressure.

AbClon said the simplification of its capital structure, combined with recent clinical readouts from global partner Henlius could mark a turning point for a re rating of the company’s valuation.

A gastric cancer therapy incorporating AbClon’s technology, AC101 (local name HLX22) drew strong market attention after data presented at the 2026 ASCO Gastrointestinal Cancers Symposium (ASCO GI 2026) showed efficacy surpassing the limitations of existing treatments.

According to long term follow up results from a Phase 2 trial (HLX22-GC-201) announced by Henlius the median progression free survival (mPFS) in the HLX22 combination group for first line treatment of HER2 positive gastric cancer had not been reached as of the data cutoff while the control group receiving standard therapy recorded an mPFS of 8.3 months.

Notably the hazard ratio (HR) stood at 0.20 (95% confidence interval 0.09–0.54) demonstrating an 80% reduction in the risk of disease progression compared with the control group.

In oncology trials an HR of 0.7~0.8 is typically considered successful making the 0.20 result exceptionally encouraging, according to AbClon.

At 24 months the progression free survival (PFS) rate reached 54.8% in the HLX22 combination arm more than three times higher than that of the control group at 17.5%.

This outcome significantly outperformed clinical results reported for competing regimens including pembrolizumab combination therapy (10.0 months) and pertuzumab combination therapy (8.5 months).

Based on the positive Phase 2 results, Henlius also unveiled plans at the conference for an ongoing global Phase 3 trial (HLX22-GC-301), which will enroll 550 patients worldwide.

The Phase 3 study will broaden its scope to include patients with low PD-L1 expression who are less likely to benefit from immuno-oncology therapies aiming to maximize the drug’s commercial potential.

An AbClon official said “This conversion to common shares is meaningful in that it streamlines the components within our capital structure and removes uncertainty related to overhang.”

adding “At the same time we are pleased to confirm AC101 data showing an HR of 0.20. The numbers themselves allow us to clearly communicate the company’s intrinsic value to the market.”

|

HyundaiBio Decides to File FDA Application for Phase 2 Basket Trial in Respiratory Viral Diseases

Shares of HyundaiBio rose 2.90% from the previous session to close at 5,330 won, extending gains for a second consecutive day.

The rally was driven by the company’s decision to file an application with the U.S. Food and Drug Administration (FDA) for a Phase 2 basket clinical trial targeting multiple respiratory viral diseases, including influenza.

The decision followed in depth discussions with U.S. public health authorities and global experts on strategies to address large scale infectious diseases during the “2026 Biotech Showcase” held recently in San Francisco.

HyundaiBio has also completed the selection of a local contract research organization (CRO) that will oversee investigational new drug (IND) related clinical trial operations with the FDA.

Overall clinical leadership will be by David Smith a professor at the University of California, San Diego (UCSD) who is widely regarded as a leading infectious disease expert. Smith previously served as international protocol chair for the U.S. government’s COVID-19 ACTIV-2 clinical program where he oversaw therapeutic selection and the broader clinical strategy.

A HyundaiBio official said “We have been engaged in strategic discussions with U.S. public health experts to flesh out preparations for a U.S. Phase 2 trial even before the Biotech Showcase.”

adding “With Dr. Smith appointed as overall clinical lead and contracts finalized with a local CRO, we will move forward without delay with FDA procedures required for the formal clinical trial application.”

![독극물 처리? 그냥 싱크대에 버려 [그해 오늘]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020900001t.jpg)

!['120억' 장윤정·도경완의 펜트하우스, 뭐가 다를까?[누구집]](https://image.edaily.co.kr/images/Photo/files/NP/S/2026/02/PS26020800099t.jpg)