|

Samsung Biologics, Korea’s No. 1 biotech by market cap

What drew more attention than Samsung Epis Holdings on Monday was Samsung Biologics, which has shed its biosimilar business entirely through a spin-off and has been reborn as a “pure contract development and manufacturing (CDMO) company.”

Samsung Biologics closed at 1.765 million won, down 1.78 percent (32,000 won) from the previous day, maintaining almost the same share price and market cap as before the spin-off. In effect, this is tantamount to a sharp rerating.

Before the spin-off, analyst Kim Seung-min at Mirae Asset Securities had valued Samsung Biologics’ CDMO business at 105 trillion won and the biosimilar business of Samsung Bioepis at 9.1 trillion won. His pre-spin-off target price for Samsung Biologics was 1.6 million won.

Given the 65:35 spin-off ratio between Samsung Biologics and Samsung Epis Holdings, Samsung Biologics’ implied corporate value after the spin-off should have been 56.5 trillion won, or 1.22 million won per share. On the actual relisting day, however, Samsung Biologics’ market cap stood at 82.8145 trillion won, or 1.765 million won per share, effectively about a 46 percent gain versus that implied value.

Taking into account the change in the share count and carving out the biosimilar value assigned to Samsung Bioepis, Kim raised his target market cap for the surviving entity Samsung Biologics to 105 trillion won and his target price per share to 2.27 million won. For Samsung Epis Holdings, he suggested a corporate value of 10 trillion won and a target price of 400,000 won per share.

As the basis for these numbers, he cited expectations that Samsung Biologics’ fifth plant will run at full capacity thanks to its order-winning power, and the fact that the company is showing the highest growth rate among CDMO peers such as Lonza of Switzerland and WuXi in China.

|

Samsung Epis Holdings: Drug innovation momentum “not yet”

Newly established through the spin-off, Samsung Epis Holdings is an investment holding company that owns biosimilar company Samsung Bioepis as a 100 percent subsidiary. It has also set up a new subsidiary, Epis Nexlab, to conduct new drug research and development.

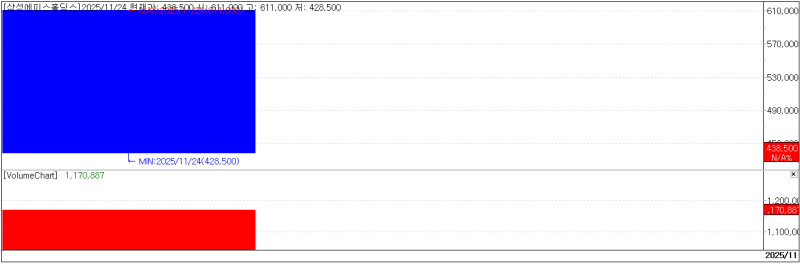

On its relisting day, Samsung Epis Holdings closed at 438,500 won, down 28.23 percent (172,500 won) from the opening price.

“There are many questions in the market about Samsung’s new drug development capabilities. For the time being, Epis Holdings is likely to remain under pressure,” a source in the investment industry told PharmEdaily.

A Samsung Epis Holdings representative commented, “We have not yet disclosed any specifics about new drug development, so questions understandably remain over how we plan to roll things out,” adding, “Going forward, we will steadily deliver on our key growth momentum, including strengthening Bioepis’s biosimilar business competitiveness and making progress in new drug development, while actively engaging in IR activities to communicate with the market and build long-term trust.”

On the biosimilar side, Samsung Epis Holdings plans to expand its product portfolio and pipeline to more than 20 products and is developing multiple follow-on candidates after its Keytruda biosimilar (SB27). To date, the company has disclosed its biosimilar pipeline when candidates entered clinical trials (Phase I), but it now plans to reconsider the timing and method of disclosure in light of stakeholder needs and transparency in information sharing, and to communicate with the market at the appropriate time.

“In terms of new drugs, Samsung Bioepis is expanding collaborations with domestic and global biopharmaceutical companies such as Intocell, Proteina, and Frontage,” the representative said. “We will carefully consider the appropriate method and timing for disclosure regarding new drug development milestones, and maintain close communication with the market.”

The newly established Epis Nexlab aims to operate as a small biotech model, developing platform technologies in new modalities to build its own pipeline or conduct joint development with global pharmaceutical companies.

“In this process, we believe early license-out deals and other arrangements will enable early recovery of investment and generate stable profit and cash flow,” the Samsung Epis Holdings representative said. “Based on our accumulated experience, securing platform technologies with strong technological edge and innovativeness should serve as a mid- to long-term growth driver for the company and enhance shareholder value.”

|

Samyang Biopharm takes off

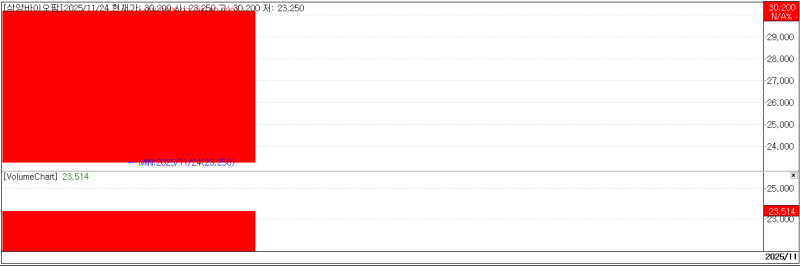

On the same day that Samsung Epis Holdings relisted, Samyang Biopharm, which was spun off from Samyang Holdings and relisted, showed a stark contrast with a steep rise from its opening price. Samyang Biopharm closed at 30,200 won, up 6,950 won (29.89 percent).

Samyang Biopharm was absorbed by its 100-percent parent holding company in April 2021 through a merger designed to secure stable funding. In June last year, after former ST Pharm CEO Kim Kyung-jin joined as head of the bio division, the group decided to spin the company out again to boost the value of the bio business and enable faster, more specialized decision-making.

Joining Samyang BioPharm are research center head Yang Juseong and quality management executive director Kim Kyung-yeon, who had previously worked with CEO Kim at ST Pharm; they now serve as head of the new drug business unit and head of CQC, respectively.

Samyang BioPharm succeeded in developing Korea’s first bioresorbable surgical suture in 1993. It currently maintains the No. 1 share in the global market for suture yarn.

The company is also strengthening its oncology-focused pharmaceutical business, building an anticancer portfolio covering seven solid tumors and five hematologic malignancies. Recently it completed a cytotoxic injectable anticancer drug plant capable of producing 5 million vials annually and has obtained GMP certification in Japan and Europe.

In addition, the company is accelerating development of next-generation drugs using its proprietary gene delivery carrier “SENS (Selectivity Enabling NanoShell).”

“This spin-off marks a major change since CEO Kim Kyung-jin took office,” a Samyang Biopharm official said. “When we were inside the holding company, it was difficult for the market to see BioPharm’s performance separately, but now, as a stand-alone listed entity, our business performance, growth potential, and technological capabilities can be evaluated independently through public disclosures.”

“Leveraging our specialty, high-function portfolio in bioresorbable surgical sutures, gene delivery carriers, and anticancer drugs, we plan to steadily enhance our corporate value,” the official added

![고맙다, 코스피!…연기금 줄줄이 '역대 최고 수익률' [마켓인]](https://image.edaily.co.kr/images/Photo/files/NP/S/2026/02/PS26021001687t.630x.0.jpg)