Dentium, a dental implant maker, drew investor interest after activist fund Align Partners increased its stake. D&D Pharmatech rose after announcing a bonus share issue.

|

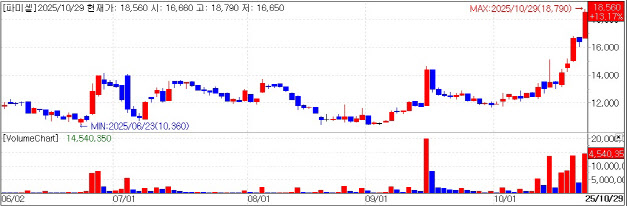

According to KG Zeroin’s MP Doctor (formerly MarketPoint), Pharmicell closed at 18,560 won, up 13.17% from the previous day. The rally is attributed to a supply contract disclosed the prior day with a Chinese subsidiary under Doosan Electronics BG (Doosan Electro-Materials) worth 4.1 billion won.

Pharmicell has co-developed resins and curing agents with Doosan Electronics BG for more than a decade and began full-scale shipments of high-performance specialty curing agents last December. The product is known to be used exclusively in the manufacture of copper-clad laminates (CCL) that go into NVIDIA’s “Blackwell” AI accelerators.

Doosan Electronics BG is said to be conducting exclusive quality testing for NVIDIA’s next-generation AI chips, with a high possibility of becoming an exclusive supplier thereafter. This has led the market to classify Pharmicell as a NVIDIA-related stock as well.

Starting with the December agreement, Pharmicell has already signed five contracts with Doosan Electronics BG this year: 4.6 billion won in April, 5.4 billion won in August, 3.9 billion won in September, 5.4 billion won in early October, and the latest deal. The interval between contracts is shortening, which is viewed positively.

A Pharmicell official said, “Each of these supply deals is executed on a per-order basis, so a new contract is signed each time. We have had supply agreements before, but the sizes were small and not subject to disclosure. Recent contracts exceed 5% of last year’s sales, so we are disclosing them in accordance with regulations.”

Dentium rises on news of activist involvement by its No. 2 shareholder

Dentium finished 4.29% higher at 58,400 won versus the prior session. The move is seen as reflecting expectations that second-largest shareholder Align Partners Asset Management will make active shareholder proposals to the company.

On the 28th, Dentium disclosed that Align Partners changed its purpose of ownership from “general investment” to “influencing management.” Align Partners holds 8.16%, second to CEO Sung-Min Jung (also head of Dentium Dental Clinic) who owns 17.34%.

Align Partners has driven shareholder-return initiatives across multiple industries. It took a 1% stake in SM Entertainment in 2021 and began making shareholder proposals the following year, drawing attention. It has since campaigned at JB Financial, Doosan Bobcat, Coway, and others. Its portfolio includes STIC Investments, Dentium, and InBody.

Industry observers suggest Align Partners may press Dentium to retire treasury shares to support the stock. As of the end of Q1, Dentium held 2,444,939 treasury shares, about 22% of total shares outstanding. Because treasury shares can serve as a management defense tool, a large-scale retirement could dilute CEO Jung’s control, some analysts say.

An Align Partners representative commented, “We intend to take actions for the purpose of influencing management at Dentium, but no specific plan has been finalized yet. We will promptly file an amended disclosure once plans are set.”

Edaily contacted Dentium about plans for treasury share retirement and shareholder returns but did not receive a response.

D&D Pharmatech up on bonus issue

After a quiet morning, D&D Pharmatech spiked as much as 14.38% to 214,000 won in the afternoon before paring gains to close 6.15% higher at 198,600 won. The surge was attributed to the company’s bonus issue announcement.

On the 29th, D&D Pharmatech said it will issue 3 bonus shares for every 1 share held, for a total of 32,568,957 new shares. Shares outstanding will rise from 10,856,319 to 43,425,276. The record date is November 14, and the new shares are scheduled to list on December 5.

D&D Pharmatech has drawn attention for its obesity-treatment programs. The company owns ORALINK, an oral delivery platform that aims to overcome limitations of current GLP-1 therapies and boost oral bioavailability.

Its oral GLP-1 candidate DD02S, built on ORALINK, showed 10~12.5× higher oral bioavailability than Novo Nordisk’s “Rybelsus” in preclinical animal studies. In 2023, D&D Pharmatech signed a technology-transfer deal with Metsera, and when Metsera was acquired by Pfizer, D&D Pharmatech drew heightened attention.

Regarding the bonus issue, the company stated: “We have long considered a bonus issue and have now made a final decision. The free float has been consistently cited as small; with this bonus issue, the total share count increases, which we expect will improve trading liquidity.”